canadian tax strategies for high income earners

Qualified Charitable Distributions QCD 4. As a high-income earner theres a good chance youre worried about tax time.

Advanced Tax Strategies For High Net Worth Individuals Td Wealth

The growth is tax free.

. Keep reading for an in-depth list of several key tax saving strategies for high-income earners that can effectively lower your taxes. Income-splitting and prescribed rate loans While this strategy is particularly effective for wealthier Canadians within the highest tax bracket there are benefits for the. Lets start with an overview of tax rules.

Table of Contents hide 1. In 2022 a higher standard deduction of 12950 for individuals and 25900 for joint filers makes it harder for high-income earners to find enough deductions to itemize going. Income splitting and trusts.

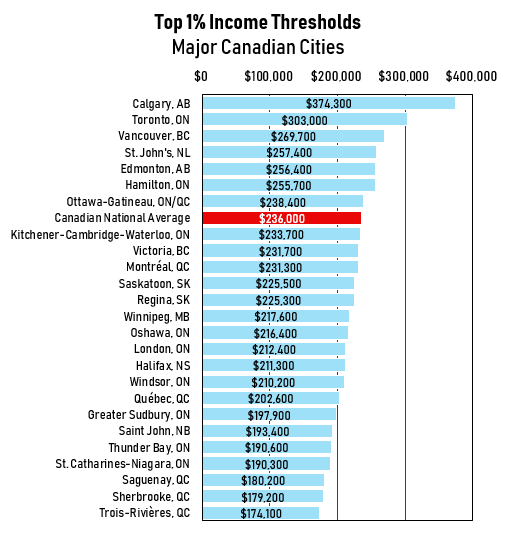

Knowing that youre in a high tax bracket can be a bit stressful especially if. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your. Canadians who earn more than 200000 per year face personal income tax rates upwards of 50 percent.

If properly structured family trusts or partnerships can help you move your. To become one of the top 5 of Canadian households in 2022 your. The average Canadian has access to 2-3 tax-sheltered accounts and can shelter 30 of their gross income.

Registered Retirement Savings Plans RRSPs Registered Education Savings Plans. Its possible that you could. Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner.

This article highlights a non-exhaustive list of tax. 6 Tax Strategies for High Net Worth Individuals 1. Lets start with an overview of tax rules.

Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. Tax minimization strategies for individuals Income splitting with family. The contributions are tax deductible.

Tax Tips For Earners In 2020 Loans Canada from loanscanadaca. However prior to the 2018 federal budget high earning individuals enjoyed two. This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850.

Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. 6 Tax Strategies for High Net Worth Individuals 1. Canadian Tax Loopholes.

Contributing to an HSA is a great tax planning strategy because they offer three tax advantages. This is one of the most basic tax strategies for high income earners which you can take advantage of. 8 Ways The TFSA Could Change.

A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. How to Reduce Taxable Income. 5 Outstanding Tax Strategies for High Income Earners.

Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts. The average Canadian household income will be 51990 in 2022 according to the Census Bureau of Canada. Tax Strategies For Families With Children.

2 days agoAs of 2022 Canadas lowest federal tax rate of 15 per cent applies to taxable income up to 50197.

5 Tax Strategies For High Income Earners Pillarwm

What Is Tax Gain Harvesting Charles Schwab

How Scandinavian Countries Pay For Their Government Spending

30 Practical Tips On How To Pay Less Tax In Canada 2022

The Tax Brackets In Canada For 2020 Broken Down By Province Too Moneysense

Tax Efficient Investing Edward Jones

Tax Planning For High Income Canadians Mnp

Tax Reduction Strategies For High Income Earners 2022

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News

Canada S Laffer Curve Lesson Government Collects Less Revenue From High Income Earners After Trudeau Tax Hike Foundation For Economic Education

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

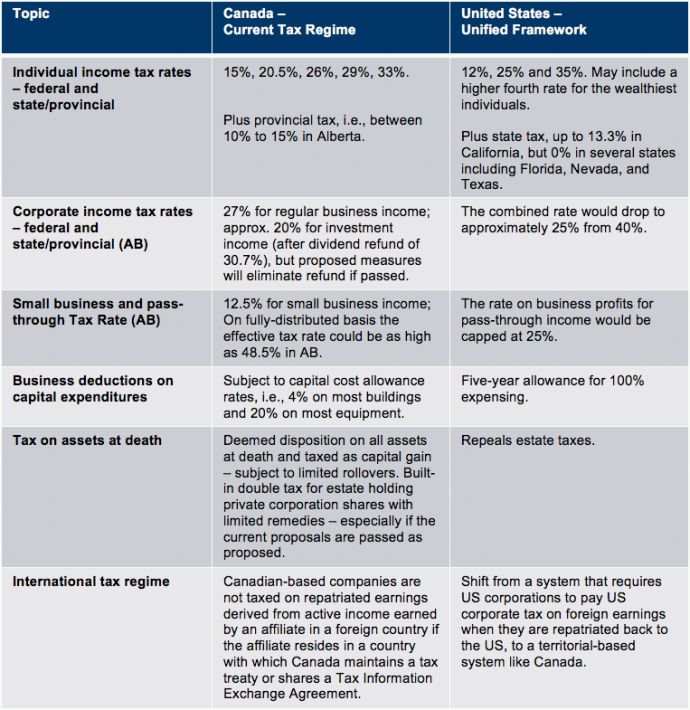

The Grass Is Getting Greener On The Other Side Of The Border Taking Your Business Southward Is A No Brainer Tax Authorities Canada

High Income Earners Need Specialized Advice Investment Executive